DJ Vlad has been an advocate for leasing cars and renting homes since the inception of VladTV. So when he interviewed Jemele Hill about receiving her first million dollar check it wasn’t unusual for him to go into a whole monologue about why he believes leasing is a better option.

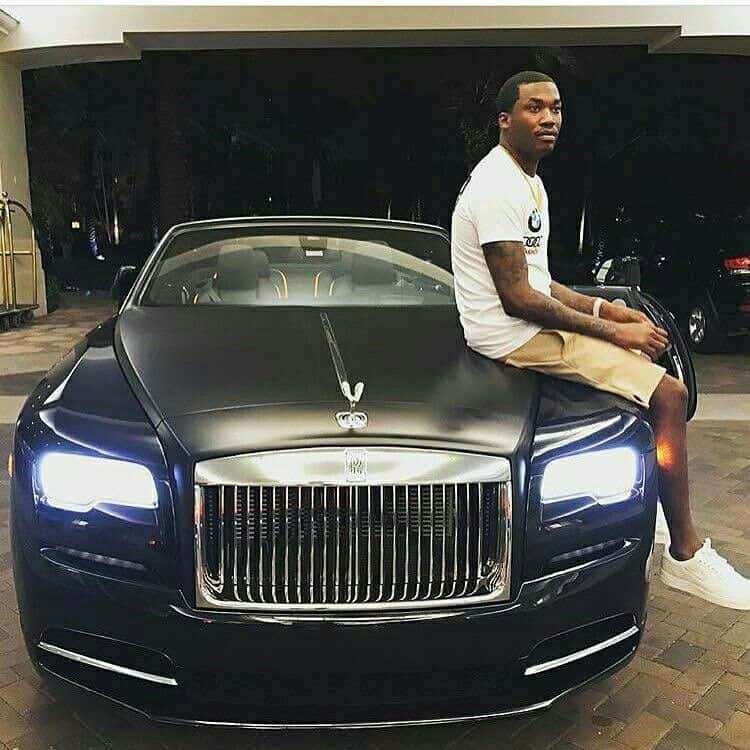

“Look at Meek Mill’s biggest song “Dreams and Nightmares Intro” where he said, you know when I pulled up in that Ferrari y’all thought it was leased and I’m looking at my leased Tesla going like, what the hell is wrong with a leased car, y’all tripping,” Vlad said. “Somehow if the Ferrari is leased it’s not really your Ferrari. Like, you can’t really drive it the way you want to drive it. It’s like you’re renting it for the weekend. No, it’s the same thing. In fact, if you talk to any rich person, they all lease their cars.”

It wasn’t long ago that 50 Cent “exposed” French Montana for flexin’ on an allegedly leased Bugatti. French Montana posted a video of his new vehicle on Instagram with the caption, “Fresh out of ICU woke up in that new Buggatti!!! Lil gift to myself! Feel like a boss move like a boss and taste like a boss.” 50 Cent responded, “he got a f—ing 60 month loan on a 08.”

Sounds like rich people problems. It makes sense that a wealthy person who wants to keep up a certain image would opt for such an expensive vehicle such as a Ferrari, which has starting prices at $200,000-plus and can run in the millions. Of course, at that level, it would be foolish to bring a Louis Vuitton duffle bag full of $200,000 cash and slam it on the table at some dealership.

For one, cars depreciate in value the moment you drive it off the lot, with the only exception being vintage or classic cars that can increase in value with time. Secondly, there’s so many things that could have been accomplished with the cash that would’ve been saved if the luxury or exotic vehicle was leased. Options in investing would’ve been a more productive alternative.

Third, similar to iPhones, the lessee gets the benefit of switching out leased vehicles every two to three years. By doing this, the lessee doesn’t have to worry about mechanical breakdowns or expensive repairs as those issues fall in the hands of the dealership. Plus, the lessee can maintain that image of having the newest vehicle to go along with that wealthy bank account.

While that type of strategy may be effective for the super wealthy, not owning your vehicle or home could be a mistake that the newly or temporarily rich could regret. Don’t get it twisted, at barely a net worth of $1 million, it’s just plain ole’ foolish to drop a $200,000 bag on a depreciating asset. That expense would decrease the $1 million net worth of a person by 20%. That’s working backwards.

However, going for a more modest option, such as a Mercedes Benz, BMW or even a Tesla that starts at $30,000-plus, and paying the bill outright can be one of the best decisions for someone who is dealing with too many variables to bet on a possibly unstable financial future.

Those variables can range from stock market crashes, natural disasters, worldwide pandemics, sudden medical emergencies, or being booed up with a con artist. Unless you are a billionaire like Jeff Bezos, Mark Zuckerberg, Elon Musk or Bill Gates, being frugal and thinking about the worst case scenario will prevent amateur mistakes such as spending large amounts of money on designer clothing and shoes, luxurious meals at expensive restaurants, unnecessary vacation trips and giving away too much money to family members and homies.

Instead, purchasing a “reasonably priced” car in full will eliminate the anxiety that comes with possible repossession of the vehicle if money gets tight and the subsequent mortification of the experience. Owning the vehicle also leads to more flexibility in making decisions on how many annual miles are appropriate for the vehicle, what type of insurance to purchase, customizing the vehicle, and choosing to sell or lend the vehicle to others.

Leasing, on the other hand, requires a high initial downpayment and delivery fee that is due at signing, which is used to level the monthly payments making it seem that on a monthly basis leasing is the more affordable option. There’s also restrictions on the number of miles that can be put on the vehicle per year and minimum coverage requirements for insurance.

If a lease is ended early, the lessee may end up with an expensive bill that feels more like a penalty. Some lessees do have the option to purchase a leased vehicle at the end of the lease term, but this could also result in paying more money for a depreciated asset.

So, in hip hop culture, where tomorrow is not promised, the fans are fickle, and the ageism is real, trying to maintain a look just so that people will admire or envy you is as dumb as handing over all your money to strippers in a strip club. Ownership is key. Own your home, own your decently negotiated priced vehicle, and alleviate yourself from the debt slave mentality that America so greatly promotes.